The home closing process typically takes 30 to 45 days and includes various steps such as financing, appraisal, title search, insurance and paperwork. The timing may be affected by factors such as the type of financing and the complexity of the deal. Closing times vary by state, some states are faster due to efficient markets and experienced professionals. Tips to speed up the process include preparing documents, working with a reliable lender, and using online filing platforms.

Buying a house is an exciting and significant milestone in the life of any person. However, before you can finally settle into your new home, an important process must take place: the home closing process. Understanding how long it typically takes to close on a home is important for both buyers and sellers because it sets expectations and allows for proper planning. In this article, we’ll look at the time frame of the home closing process, factors that can affect the time frame, a step-by-step guide to closing, the average closing time in different states, and tips for a smooth and efficient closing. Whether you are a first-time home buyer or a seasoned seller, this article will provide valuable insight into the often complex and time-consuming process of closing on a home.

- 1. “Understanding the Timeline: How Long Does the Home Closing Process Typically Take?”

- 2. “Factors that can affect the closing period: what should be considered”

- 3. “Step by Step Guide: Breakdown of the Home Closing Process”

- 4. “Average Closing Times Across States: Regional Differences to Know”

- 5. “Tips for a smooth and effective closing: how to speed up the process”

1. “Understanding the Timeline: How Long Does the Home Closing Process Typically Take?”

Understanding the Timeline: How long does the home closing process typically take?

The home closing process can vary depending on a variety of factors, including the complexity of the deal, the type of mortgage being used, and the efficiency of the parties involved. However, on average, the home closing process usually takes 30 to 45 days. It is important to note that this estimate is a general guideline and is subject to change.

The home closing process involves several steps that must be completed before the transfer of ownership can take place. This includes obtaining financing, conducting a home appraisal, completing the title search, securing homeowners insurance, and completing all necessary paperwork. Each of these steps requires time and coordination between the buyer, seller, real estate agents, lenders, and other parties involved.

One of the main factors that can affect the length of the home closing process is the mortgage approval process. If the buyer needs financing, he will need to fill out an application, provide all necessary documentation,

2. “Factors that can affect the closing period: what should be considered”

When it comes to the time it takes to close on a home, there are several factors that can affect that time frame. It is important for potential home buyers to consider these factors to ensure a smooth and timely closing process.

One key factor that can affect closing times is the type of financing used. Different loan programs have different requirements and terms. For example, conventional loans typically have a faster closing process compared to government loans such as FHA or VA loans. The reason for this difference lies in the additional documentation and stricter rules related to government loans. Therefore, it is important for buyers to know about the specific requirements of the chosen loan program and plan accordingly.

Another factor to consider is the complexity of the deal. If a home buyer is purchasing a property with multiple owners, or if there are any legal or title issues, the closing process may take longer. Resolving these complexities may require additional time and documentation, resulting in a delay in the closing date. It

3. “Step by Step Guide: Breakdown of the Home Closing Process”

The home closing process can be complex and time-consuming, with several steps that must be completed before the deal closes. To help you navigate the process, here’s a step-by-step guide that will give you a breakdown of what to expect.

1. Offer and Acceptance: This is the initial stage where the buyer makes an offer to purchase the home and the seller accepts it. This is usually done through a written agreement known as a sale and purchase agreement.

2. Home Inspection and Appraisal: Once the offer is accepted, the buyer arranges for a professional home inspection to assess the condition of the property. At the same time, the lender orders an appraisal to determine the market value of the home. These steps are critical to ensure that the property is free of serious problems and that the purchase price is fair value.

3. Loan Application and Underwriting: The buyer will need to apply for a loan to the selected lender and provide all necessary documentation such as income

4. “Average Closing Times Across States: Regional Differences to Know”

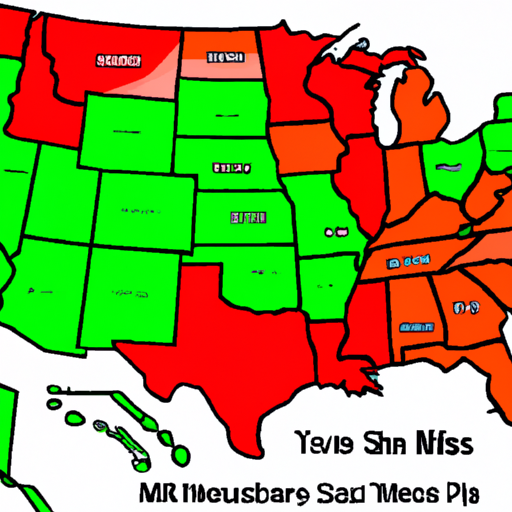

When it comes to buying a home, the time it takes to close can vary greatly depending on the state you’re in. Understanding regional differences in average closing times is critical because it can help you plan and manage your expectations accordingly.

In some states, the foreclosure process can be relatively quick, taking an average of 30 to 45 days. These states often have well-established and efficient real estate markets with established processes and experienced professionals who can expedite the closing process. Examples of states with shorter closing times include California, Texas, and Colorado.

On the other hand, there are states where the foreclosure process tends to take longer and can take anywhere from 60 to 90 days. These states may have more complex legal requirements, additional inspections, or stricter regulations that can slow down the process. New York, New Jersey and Florida are known for having longer closing times compared to other states.

It is important to note that these are only general averages and individual circumstances

5. “Tips for a smooth and effective closing: how to speed up the process”

Closing on a home can be an exciting but stressful time for home buyers. The process can often seem overwhelming, with many documents to review, inspections to complete, and negotiations to complete. However, there are a few tips that can help speed up the closing process and ensure it runs smoothly and efficiently.

1. Be Prepared: One of the best ways to speed up the closing process is to come prepared. Make sure you have all the necessary papers and documents such as ID, proof of income, bank statements, tax returns and any other necessary financial documents. Being organized and having everything at hand will save time and prevent delays.

2. Work with a reliable lender: Choosing the right lender is critical to speeding up the closing process. Look for a lender with a reputation for efficiency and strong communication skills. They should be available to answer any questions and provide updates throughout the process. A reliable lender will also have a simplified online platform for submitting documents and processing the necessary papers.

3

In summary, home closing times can vary based on many factors. Understanding the stages of the closing process and considering the various factors that can affect the time frame is critical for both buyers and sellers. While average closing times vary from state to state, it’s important to keep regional differences in mind. By following the provided step-by-step guide and using tips for a smooth and efficient closing, people can speed up the process and ensure a successful and timely closing on their new home. Whether it takes a few weeks or a few months, with the right knowledge and preparation, closing on a home can be a seamless and exciting experience.

Purex find

Purex find