Closing on a home can take anywhere from 30 to 45 days, with factors such as the complexity of the deal and the efficiency of the parties involved affecting that timeline. This process includes steps such as inspections, document checks and approvals. Strategies to expedite the process include preparing financials in advance and promptly scheduling inspections and evaluations. Closing times may vary from state to state in the US due to factors such as the complexity of the transaction and additional requirements.

Buying a home is an exciting milestone in anyone’s life, but it can also be a difficult and time-consuming process. One of the most important stages in this journey is the closing process. Closing the house involves the completion of the sale agreement, the transfer of funds and the legal transfer of ownership from the seller to the buyer. However, home closing times can vary based on various factors. In this article, we’ll look at typical home closing timelines, factors that can affect the closing process, a step-by-step guide to understanding the process, and tips on how to speed up the process and avoid delays. Additionally, we’ll delve into the differences in closing times across states, including regional practices and general factors that may affect the schedule. Whether you are a first-time home buyer or a seasoned real estate investor, understanding the closing process and the time frames involved is essential to a successful and hassle-free home purchase.

- 1. “Understanding the Timeline: How Long Does It Typically Take to Close on a Home?”

- 2. “Factors affecting the closing process: what can speed up or delay the terms”

- 3. “Step-by-step instructions: breakdown of the closing process and approximate time frames”

- 4. “Smooth Closing Tips: Strategies to Speed Up the Process and Avoid Delays”

- 5. “Closing Timeframes Across States: Regional Differences and Common Practices”

1. “Understanding the Timeline: How Long Does It Typically Take to Close on a Home?”

Closing a house is a complex process that includes several stages and parties. It is important for both buyers and sellers to clearly understand the timeframes involved in the closing process. While the exact time it takes to close on a home can vary based on a variety of factors, there is a general timeline that can help people set realistic expectations.

It usually takes 30 to 45 days to close on a home. This period begins after the signing of the contract of sale by the buyer and seller. However, it is important to note that this schedule can be affected by several factors, such as the complexity of the deal, the type of financing used, and the performance of the parties involved.

The first step in the closing process is to complete the due diligence period. This is the time when the buyer conducts an inspection, appraisal and reviews the necessary documents to ensure that the property meets their expectations. The duration of this period can vary, but usually takes

2. “Factors affecting the closing process: what can speed up or delay the terms”

Home closing times can vary depending on many factors. While the closing process is generally expected to take 30 to 45 days, several factors can either speed up or delay the timeline. Understanding these factors can help potential home buyers better predict the length of the closing process.

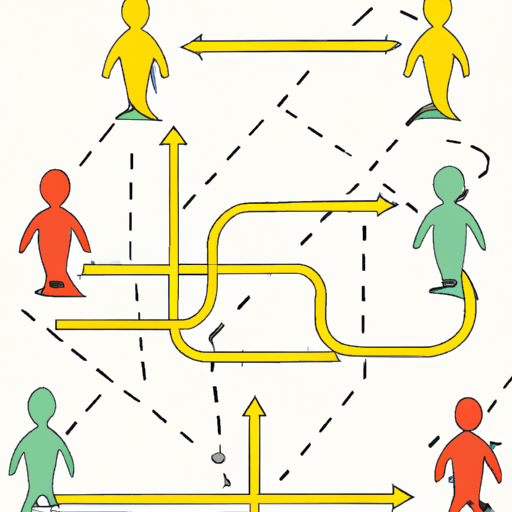

One key factor that can affect closing times is the complexity of the transaction. If there are multiple parties involved in the sale, such as sellers, buyers, real estate agents, lenders, and attorneys, it can take longer to agree all the necessary documentation and negotiate. Additionally, if there are any unique circumstances, such as the need for additional inspections or appraisals, this can further extend the closing process.

Another factor that can affect timing is the mortgage approval process. If a buyer needs financing to purchase real estate, the lender will typically conduct a thorough review of the buyer’s financial documents, credit history, and proof of employment. Delays in getting mortgage approval due to issues

3. “Step-by-step instructions: breakdown of the closing process and approximate time frames”

Completing the process of buying a home can be a complicated and time-consuming process. This includes various steps that must be completed before the sale is completed and ownership is transferred to the buyer. To give you a better understanding, here’s a step-by-step guide that breaks down the closing process and provides an approximate time frame for each step.

1. Offer and Acceptance: Once you’ve found a home you want to buy, you’ll send an offer to the seller. The seller can accept your offer, reject it, or make a counter offer. This process can last from several days to several weeks, depending on the negotiations and the readiness of both parties.

2. Home Inspection and Appraisal: Once an offer is accepted, it is very important to hire a professional home inspector to thoroughly inspect the property. The inspection usually takes a few hours and the inspector will provide you with a detailed report highlighting any issues. In addition, the lender will require an appraisal to determine the market value of the property.

4. “Smooth Closing Tips: Strategies to Speed Up the Process and Avoid Delays”

Closing on a home can be an exciting yet nerve-wracking experience. This is the final step in the home buying process and includes various tasks that must be completed before ownership is officially transferred to the buyer. While the time it takes to close on a home can vary based on several factors, there are certain strategies that can help speed up the process and avoid unnecessary delays.

1. Prepare your finances ahead of time: One of the biggest causes of delays during the closing process is financial issues. To avoid this, make sure all your financial documents are in order well in advance of the closing date. This includes bank statements, pay slips, tax returns and any other relevant documents that the lender may need. Preparation will help ensure a smooth and fast transaction.

2. Schedule inspections and appraisals early: Inspections and appraisals are important steps in the home buying process. It is important to schedule them as soon as possible after your offer is accepted. Delays in

5. “Closing Timeframes Across States: Regional Differences and Common Practices”

Closing dates can vary significantly from state to state in the United States. While there is no set schedule for a home closing, understanding regional differences and common practices can give potential home buyers a general idea of what to expect.

In some states, the average time it takes to close on a home can be relatively quick, ranging from 30 to 45 days. These states typically have streamlined processes and efficient real estate markets. For example, states like Colorado, Texas, and Arizona are known for their fast closing times.

On the other hand, certain states may have longer closing times due to various factors. In states such as New York, California and Florida, where real estate transactions can be more complex and competitive, it is not uncommon for the closing process to take 60 to 90 days or even longer. These states often have additional requirements, such as mandatory home inspections or more documentation, which help extend the time frame.

Another factor that can affect closing times is

In summary, home closing times can vary based on a variety of factors. However, by understanding the time frame, being aware of the factors that can affect the closing process, following step-by-step instructions, and implementing strategies to speed up the process, homebuyers can navigate the closing process more smoothly and avoid unnecessary delays. Additionally, it’s important to note that closing time frames can vary from state to state, so it’s important to familiarize yourself with regional differences and common practices to better prepare for the foreclosure process. Ultimately, with the right knowledge and preparation, home buyers can successfully close on their dream home on time.

Purex find

Purex find